Business Ethics

Business ethics refer to implementing appropriate business policies and practices with regards to subjects including corporate governance, insider trading, bribery, discrimination, corporate social responsibility, and fiduciary responsibilities. A strong and fully embedded commitment to undertaking business ethically brings considerable benefits, including improved consumer perception (leading to increased loyalty), greater investment, reduced costs, and enhanced employee motivation, involvement and interaction to name just a few. JSW has always recognized its moral obligation to do all that it can to operate its business to the highest standards of personal and professional integrity, honesty and transparency, recognizing the intrinsic benefits that good business ethics and governance provide. However, in spite of all that we have so far achieved in operating our business ethically, we recognize that there remains a potential for us to do much more. JSW is committed to embed sound governance, deliver transparency, tackle corruption, manage risks and provide value through strong and robust business ethics. The major operations of Integrated Steel Plants of JSW are ISO 9001, 14001, 45001, 50001 compliant

Corporate Governance

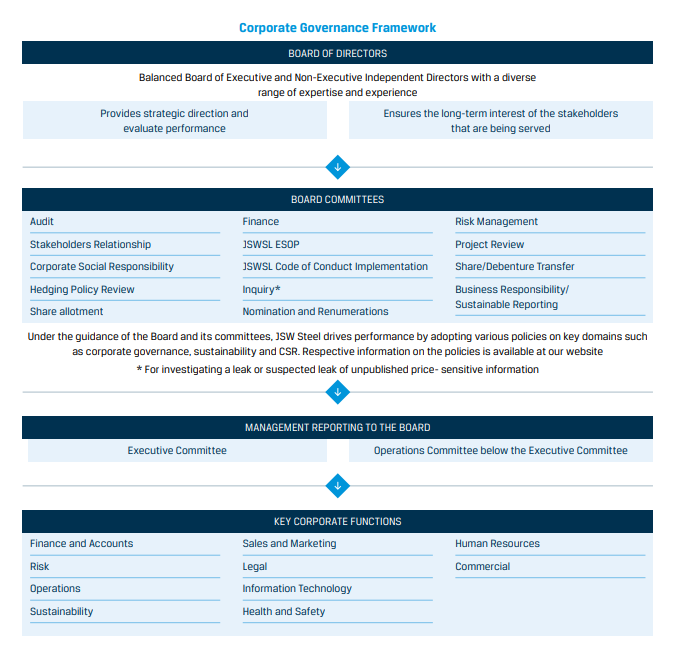

With the aim to ensure that the Company keeps the stakeholders’ interests at the centre of all operations and business decisions, JSW Steel follows a stringent corporate governance policy. Transparency and openness are the core principles of corporate governance at JSW Steel and it has established a corporate governance structure that works towards achieving sustainable growth in the medium- and long-term.

The Board of Directors oversee the overall functioning of JSW Steel. They also provide and evaluate the strategic direction of the Company, management policies and their effectiveness and ensure that the long-term interest of the stakeholders are being served. The Chairman and Managing Director is assisted by the Executive Directors/ Senior Managerial Personnel in overseeing the functional matters of JSW Steel.

- Board of Directors: The Company's Board of Directors consists of global thought leaders who create trust by example. They ensure that the highest levels of corporate governance are practiced through the organization. The Company's Board comprises:

- Chairperson Emeritus - Mrs. Savitri Devi Jindal

- Chairman & Managing Director - Mr. Sajjan Jindal

- Joint Managing Director & Chief Executive Officer - Mr. Jayant Acharya

- Whole-time Director & Chief Operating Officer - Mr. Gajraj Singh Rathore

- Director, Commercial & Marketing - Mr. Arun Sitaram Maheshwari

- 2 Nominee Directors - Mr. Hiroyuki Ogawa, Mrs. Khushboo Goel Chowdhary

- 6 Independent Non-Executive Directors - Mr. Seturaman Mahalingam, Mr. Haigreve Khaitan, Mr. Marcel Fasswald, Mrs. Nirupama Rao, Ms. Fiona Jane Mary Paulus, Mr. Sushil Kumar Roongta

We adhere to the minimum attendance criteria as per the Companies Act, 2013. In accordance with Section 167-1 (b) of Companies Act, directors are required to attend a minimum of one meeting conducted during the year - following which, a Director shall incur disqualification if he/she does not meet the minimum attendance criteria and absents himself/herself from all the meetings of the Board of directors held during a period of twelve months with or without seeking leave of absence from the Board. During FY 24-25, 8 board meetings were held, hence the minimum attendance requirement was 1 out of 8, which works out to 12.5%. This is in alignment with requirements of SEBI LORR. All Directors have duly met the attendance criteria.

- Corporate Governance Framework

At JSW Steel, the Board of Directors steers governance and strategic direction, safeguarding long-term stakeholder interests. Strategy execution and operational decisions rest with the Executive Committee, comprising senior executives who collaborate closely with Board Committees to uphold strong governance, ethical standards, and alignment with our Company’s strategic objectives.

- Stakeholder Grievance Mechanism: JSW Steel is committed to promoting responsible behaviour and value for social and environmental well-being. We have a policy on business conduct that is applicable to all our employees and value chain partners. We also have a structured stakeholder grievance redressal mechanism through which stakeholders freely share their concerns and grievances with the Company. In FY 25, we received some shareholder feedback and issues and all of them were satisfactorily resolved.

- Whistleblower Policy: We formulated the whistleblower policy / vigil mechanism in order to provide a mechanism for Directors and employees of JSW Steel to approach the Ethics Counsellor/ Chairman of the Audit Committee of the Board to report genuine concerns about unethical behaviour, actual or suspected fraud or violation of the Code of Conduct or Ethics Policy, or any other unethical or improper activity.

Whistleblower Mechanism : At JSW Steel, we are deeply committed to fostering a culture of integrity, transparency, and accountability. Our whistleblowing mechanism is a vital part of our governance framework, designed to empower individuals to report concerns related to unethical conduct, policy violations, or any form of misconduct without fear. We have established a dedicated Ethics & Compliance team that oversees the whistleblowing process under the supervision of our Audit Committee. To ensure impartiality and build trust, we have partnered with an independent third-party service provider to operate our reporting channel. This platform is accessible around the clock and supports multiple languages, making it easy and secure for individuals to raise concerns. We recognize the importance of anonymity in encouraging people to come forward. Therefore, we allow whistleblowers to submit reports anonymously, and we are committed to protecting their identity throughout the process. All reports are treated with strict confidentiality, and access to the information is restricted to authorized personnel involved in the investigation. We maintain a zero-tolerance policy towards any form of retaliation against whistleblowers. We are committed to protecting those who report concerns in good faith, and any retaliatory action is treated as a serious violation of our Code of Conduct. To ensure that our employees are aware of and confident in using the whistleblowing mechanism, we conduct regular training and awareness programs. These initiatives help our teams understand how to access the reporting channel, what types of issues can be reported, and the protections available to them. Every report we receive is handled through a structured and transparent investigation process. We begin with a preliminary assessment to determine the validity and seriousness of the concern. If necessary, we initiate a detailed investigation, with findings reviewed by the Ethics Committee and, where appropriate, escalated to the Audit Committee. We ensure that all outcomes are documented, corrective actions are implemented, and follow-ups are conducted to prevent recurrence.

- Sustainability Linked Remuneration : ESG criteria are a mandatory Key Result Area (KRA), integral to our top leadership's performance assessments, including the CEO and all Executive Directors. These factors significantly influence their variable compensation, comprising about 15-20% of their overall performance rating. Key areas such as safety, environmental stewardship, climate change, community impact, product responsibility, and governance are central to these targets.

- Director’s Liability : In alignment with Clause 196 of the Articles of Association, which addresses matters of indemnity and director responsibility, and pursuant to Regulation 25(10) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended, JSW Steel has appropriate coverage for its Directors. As such there are no limitations on directors’ liabilities, however, as part of its governance framework, JSW Steel maintains a Directors & Officers Liability Insurance policy for a defined term, with coverage tailored to the nature and extent of risks as assessed by the Board. The current policy, effective until mid-2026, provides substantial protection, consistent with industry practices and regulatory expectations.

- Bylaws: In accordance with the provisions of Section 14 of the Companies Act, 2013, any alteration to the Articles of Association (commonly referred to as the bylaws) of JSW Steel Limited shall be effected only by passing a special resolution at a general meeting of the shareholders. The proposed amendments must first be approved by the Board of Directors and subsequently placed before the shareholders for their consideration and approval.

- CEO Succession Plan : We have a robust succession planning framework in place, overseen by the Nomination & Remuneration Committee (NRC), which ensures leadership continuity across the Board of Directors, Key Managerial Personnel (KMPs), and Senior Management Personnel (SMPs). The NRC plays a strategic role in identifying and building successors for critical roles, aligning these plans with the Company’s long-term objectives. By maintaining a balanced mix of experience and fresh perspectives, the Company fosters a dynamic leadership pipeline. As part of this approach, international exposure is provided to identified successors to equip them with comprehensive business insights. As of May 2025, succession coverage for key leadership roles stood at 77%, with successors identified for 20 out of 26 positions, reflecting the Company’s commitment to proactive talent development and organizational resilience.

-

CEO Compensation Success Metrics : At JSW Steel, the CEO’s compensation is structured to reflect the Company’s commitment to performance-driven leadership and long-term value creation. The annual variation in the CEO’s remuneration is directly linked to a comprehensive performance evaluation process that considers multiple dimensions of executive effectiveness. Key factors include the CEO’s tenure, leadership capabilities, domain expertise, strategic contribution to the Company’s growth, and efforts in human resources development. Evaluations are conducted using a balanced and transparent framework that adheres to reasonable standards and incorporates both quantitative and qualitative metrics. Financial performance indicators such as sales and operating income, which underpin critical ratios like Return on Equity (ROE) and Return on Invested Capital (ROI), form a core part of the assessment. Comparative benchmarks, including stock price movement relative to steel industry peers, competitiveness, and ESG parameters are also considered to ensure market alignment and stakeholder accountability

- Clawback Clause : We have a clawback provision in place for our CEO. Mr Jayant Acharya was re-appointed as the Whole-time Director of the Company, designated as ‘Jt. Managing Director & CEO’, for a period of five years, with effect from May 7, 2024. Clawback option was a provision of this proposal, as approved during the annual general meeting.

- Code of Conduct: Our Company's Policy on Business Conduct acts as a guiding compass for both the organization and its employees. By adhering to this policy, we strive to foster a culture of ethical and responsible business practices.

All employees, including board of directors, are required to adhere to the code of conduct and laws and regulations of the country wherein we operate. Violations of these laws can result not only in severe fines for the company and also for individuals linked to the company. Every employee is held accountable for their behavior under the Code of Conduct policy. In case of any violation to the code of conduct, the covered employee may be subject to disciplinary action after the investigation. Moreover, employee performance appraisal and subsequently employee remuneration is closely linked to adherence to the Code of Conduct, with potential consequences including disciplinary action for failure to comply which may include even termination from the organisation. More information can be found here.

- Cybersecurity: For us, cybersecurity is a top priority. As we embed digitalisation into our operations, our business is more prone to cyber threats. We have meticulously devised ways through which we can protect our business and our stakeholders, through various vulnerability and breach assessments, keeping ourselves updated as per the industry best practices. This is headed by our Chief Information Officer and overseen by the Risk Management Board Committee.There were zero cybersecurity breaches or breaches of customer privacy data during FY 2024-25.

Information security-related business continuity plans: At JSW Steel, we recognize the critical importance of safeguarding our digital infrastructure and ensuring business continuity in the face of potential cyber threats. Our information security-related business continuity plans are designed to maintain operational resilience, minimize downtime, and protect sensitive data during disruptions. These plans are regularly reviewed and tested to ensure effectiveness. Internal audits of the IT infrastructure and/or information security management systems (ISMS): We also conduct internal audits of our IT infrastructure and information security management systems to identify vulnerabilities, assess whether ISMS conforms to JSW’s own requirements for its Information Security, the requirements of the standards and to evaluate effectiveness of the IT general controls. Corrective actions shall are taken in case of any non-conformity to the requirements. The effectiveness of the corrective action taken shall be reviewed and changes shall bemade to the information security management system, if required. The audit is carried out as per the Internal Audit Plan approved by the Audit Head. Escalation process for employees to report incidents, vulnerabilities or suspicious activities: To further strengthen our security posture, we have established a clear escalation process that enables employees to report incidents, vulnerabilities, or suspicious activities promptly. This process ensures that all reports are addressed swiftly by the relevant teams, with appropriate follow-up and resolution to prevent recurrence and mitigate risks. We continuously assess and monitor our IT infrastructure to identify potential vulnerabilities and emerging threats, responding swiftly to incidents, implementing effective mitigation strategies, and maintaining transparent communication with stakeholders to ensure timely disclosure of threats, actions taken, and measures to prevent recurrence. Concerns for IT related issues are to be mailed to contacts@jsw.in - Corruption and Bribery JSW Steel is deeply committed to upholding the highest standards of ethical conduct and legal compliance across all operations. Our comprehensive training programs are central to this commitment.

We are steadfast in our dedication to preventing bribery. We expect all personnel to proactively avoid conflicts of interest and commit to acting with full transparency, unequivocally condemning any illegal actions undertaken to gain an advantage.

Currently, our full-time employees (FTEs) are being trained on critical policies, including our business code of conduct, whistleblower policy, and specific modules addressing corruption and bribery, anticompetitive practices, and conflict of interest issues. We aim to achieve 100% coverage of our FTEs by 2030. A similar robust training & awareness program is also in place for our contractors

Furthermore, we are dedicated to fostering a culture of integrity through targeted awareness:- We will educate 100% of employees on topics related to fraud by 2030.

- We commit to never taking part in any money laundering activities and will educate 100% of employees on money laundering topics by 2030.

- We are committed to respecting the rules and principles of fair competition and will educate 100% of employees on anti-competition topics by 2030

- Finally, we are committed to the responsible management of confidential information

In FY 2024-25, there were zero cases of money laundering or insider trading.

- Contributions: During FY 2024-25, we contributed ₹12 crores to our affiliated trade associations which primarily consist of membership, annual subscription fees Donations and contributions given to charitable and other funds during the year was ₹73.93 lakhs. These contributions were directed exclusively to non-political entities. We did not make any contributions to lobbying, interest representation or or similar, any political party, or other spendings (eg. related to ballot measure or referrendums) contributions in the past 4 years. These contributions are in line with our policies.

Top contributions and other spending towards trade associations during FY 2024-25:- World Steel Association - ₹4.59 crores

- Institute for Steel Development & Growth - ₹1.77 crores

- Indian Steel Association - ₹1.18 crores

All the policies of JSW Steel can be found here.

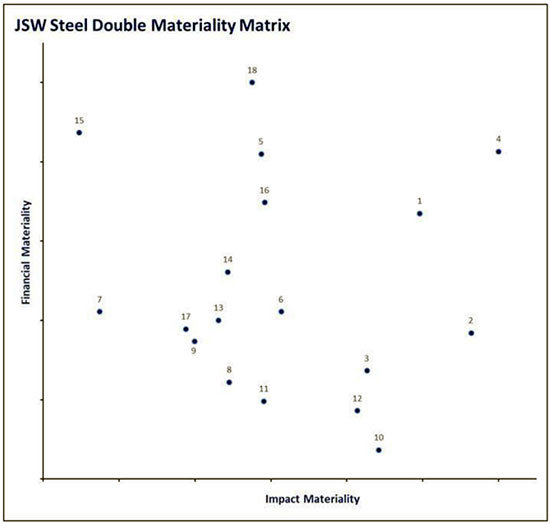

Double Materiality Assessment

We have conducted a comprehensive double materiality assessment to pinpoint critical issues that could influence our long-term value creation, the results of which can be seen in the materiality matrix below. This assessment is pivotal in shaping a detailed and strategic roadmap aimed at ensuring sustainable value delivery. The results of our materiality assessment have been reviewed and signed off by the board of directors.

| Topic Number | Material Topic |

|---|---|

|

1 |

Climate Change & GHG Emissions Management |

|

2 |

Air Emissions & Air Quality Management |

|

3 |

Water Resource Use & Management |

|

4 |

Energy Use & Management |

|

5 |

Resource Use & Management |

|

6 |

Waste Management |

|

7 |

Circular Economy |

|

8 |

Impact on Biodiversity |

|

9 |

Waste Water |

|

10 |

Occupational Health & Safety |

|

11 |

Vendor Management & Development |

|

12 |

Anti-Corruption |

|

13 |

Training & Education |

|

14 |

Investment in Clean Technology & Environmentally Friendly Products |

|

15 |

Digitalization & Automation |

|

16 |

Technology, Product & Process Innovation |

|

17 |

Diversified Product Portfolio |

|

18 |

Economic Performance |

Sustainability Policies

Sustainability issues such as Climate Change, Water, Waste, Biodiversity, etc. are likely to affect our sites, or our Group as a whole. To define the certain expectations for management of environmental issues and improving our environmental performance, we have devised our sustainability policies which includes Climate Change Policy, Waste Management Policy, Water Management Policy, etc. Our sustainability policies drive our sustainability management practices at all our operations, business facilities, suppliers and service providers, distribution & logistics and other key business partner. Our endeavor is that our sustainability policies encompass our due diligence process for mergers & acquisitions. The policies showcase our commitment to ensure compliance with laws and regulations, setting targets and improve our environmental performance. They also showcase our commitment to conducting trainings and awareness sessions for our internal and external stakeholders including employees, for the sustainability policies, as well as the impacts of their work activities on the environment and society. These are available on our website at JSW - Sustainability - Policies. The implementation of these Sustainability Policies is the responsibility of the respective business heads, with the monitoring and tracking done by the Climate Action Group, under the guidance of the Business Responsibility / Sustainability Reporting Committee of the Board.

Reporting & Disclosure

The Company is committed to pursuing its business objectives ethically, transparently and with accountability to all its stakeholders. The Company believes in demonstrating responsible behavior while adding value to the society and the community, as well as ensuring environmental well-being with a long-term perspective. To adhere to the above said commitments, JSW Steel discloses information related to Environment, Social & Governance (ESG) parameters initiatives taken by the company in its annual Integrated Report.

The Annual Integrated Report is prepared on the guidelines of Global Reporting Initiatives (GRI), and has provided with requisite mapping of the principles of the National Guidelines on Responsible Business Conduct (NGRBC) in order to fulfill the requirements of the Business Responsibility and Sustainability Report (BRSR) framework as per directive of SEBI, and also is in line with the United Nations Sustainable Development Goals.

Risk Management

- JSW has always been proactive in managing its risks as it believes that success in a challenging and dynamic external environment is largely dependent on an organisation’s ability to be agile and respond to changes quickly and effectively. This forms the basis of the risk management process at JSW Steel, which is well geared to identify, assess and manage traditional as well as new-age risks, thereby protecting stakeholder interests, achieving business objectives and enabling sustainable growth. JSW Steel follows the globally recognized Committee of Sponsoring Organisations of the Treadway Commission (COSO) framework for risk management. The Company has constituted a sub-committee of Directors to oversee the Enterprise Risk Management framework. It monitors risks related to performance, operations, compliance, incidents, processes and systems and tracks their mitigation plan till their closure.

- We conduct an independent internal audit of our risk management processes and principles annually. Risk exposure is reviewed twice a year by the Board Risk Management Committee. High risks reported in Risk Management Committee are a part of the internal audit plan and internal audits of those high risks are conducted annually.

- We conduct regular risk management training and awareness sessions for our board of directors and all our employees. The objective is to educate employees on risk management principles and practices, building risk culture and leadership, risk rating, risk assessment process, among others through diverse channels, including seminars, workshops, and online training sessions. In addition to this, we also conduct focused training programs to address the risks of identified material topics such as Health and Safety, ESG, ethics, POSH, Cybersecurity, etc.

- The Board of Directors, during each meeting, is given presentations covering global steel sector scenario, peer analysis, global/Indian economy, significant geo-political events impacting the steel sector, company’s financials, sales, production, business strategy, subsidiary’s performance and risk management practices before taking on record the quarterly/half-yearly/nine monthly/annual financial results of the company. Under the Independent Director familiarization program, independent directors are given presentations of the company's strategies to manage risks as well as monthly updates on performance and any developments which affect the company.

- Enterprise Risk Management (ERM) framework has been rolled out in the entire group. All the designated risk owners are well aware of this Risk Management framework, and new risks are identified by individual risk owners.

- The Company gives thrust on sustainable products that are safe for our consumers. JSW Steel has developed products that are environment friendly & safe for usage like high-strength low carbon steel, low thickness steel used in the auto sector which makes the vehicle lighter and in-turn helps in reducing the carbon footprint while maintaining the safety of the travelers. We also conduct a SWOT analysis to determine any risks before new product development & its approval process.

- We have achieved notable milestones in the domain of Product Sustainability, becoming the first manufacturer to earn the prestigious GreenPro ecolabel for Automotive Steel products. We have also received the GreenPro certification for JSW Neosteel TMT bars and 14 categories of Roofing Sheets. Additionally, we have obtained Environmental Product Declarations (EPDs) for 14 finished products from three integrated steel plants and 5 finished products from three downstream plants, offering reliable and standardised insights into the lifecycle of various products.

- At JSW Steel, all employees’ performance evaluation and promotions are impacted by risk-related performance and other factors. Risk management and compliance with risk procedures are a part of the Key Result Areas (KRAs) of senior management who are designated employees in charge of risk management and is linked to their variable incentives. Safety is a mandatory part of KRA for senior executives with a weightage of 15-25%. The variable performance pay (incentives) is linked to this KRA. The following safety criteria are part of the KRAs for Senior executives: Lost time injury frequency rate (LTIFR, Number of reportable incidents, Zero Fatal incidents, and these are considered during the annual performance appraisal. Safety KRAs are also set for middle and lower management with a weightage of 10-15% & the variable pay of the managers is linked to achieving these KRAs.

- JSW Steel follows the globally recognised Committee of Sponsoring Organisations (COSO) framework for Enterprise Risk Management (ERM) which helps integrate internal controls into business processes. The Risk Management Policy of the Company, which is approved by the Risk Management Committee of the Board and the Board of Directors, provides the framework of Enterprise Risk Management (ERM) by describing mechanisms for the proactive identification and prioritization of risks based on the scanning of the external environment and continuous monitoring of internal risk factors. The ERM framework identifies, evaluates, manages and reports risks arising from the Company’s operations and exogenous factors. The Company has deployed bottom-up and top-down approaches to drive enterprise-wide risk management. The bottom-up process includes identification and regular assessment of risks by the respective Plants/Corporate functions and implementation of mitigation strategies. This is complemented by a top-down approach where the Risk Management Group as well as the Risk Management Committee (RMC) identifies and assesses long-term, strategic, and macro risks for the Company. Risk Severity is determined after considering 2 factors: Impact on Business & Probability of Occurrence. Basis this, a Risk Severity matrix is constructed, and the risk appetite of the company is determined accordingly.

- Overview of the risk management process

- Risk ownership - There are three main aspects of risk management process, i.e. risk identification, risk assessment and risk response (e.g., avoid, mitigate or retain). Identification, assessment, response and tracking of risks under their control are ensured by the risk owners (HODs) at respective locations. Risk is identified by the risk owners at the plant level, which is reviewed at respective plant-level risk committees, headed by the plant head.

- Corporate risks - All the plant-level risks and risks of corporate functions as well as organizational risks requiring review of the macro environment, policies and processes are discussed at the corporate meetings. The corporate risk committee is headed by the JMD.

- Board of Directors – All the key risks identified at corporate risk committee meeting are presented to the board and all plants & corporate updates on risk mitigation action status on a half-yearly basis are reviewed by the Board of Directors.

- All these activities are coordinated by the Chief Risk Officer.

- Enterprise Risk Management Framework JSW Steel has compiled a robust ERM framework while adhering to the Committee Of Sponsoring Organisations Framework (COSO) to facilitate the integration of internal controls into our business process. The Risk Management Committee of the Board of Directors chaired by an independent director ensures that the company understands the impact of the risks and has implemented mitigation measures towards the same. The 13 risks that were identified are as follows-

|

R1. Macroeconomic Risk |

R2. Steel Industry is Cyclic in Nature |

R3. Raw material availability and cost of iron ore and coking coal |

R4. Infrastructure and logistics supply chain risk |

|

R5. Mergers and Acquisitions |

R6. Market Risk |

R7. Foreign Exchange Fluctuations |

R8. Utilities- Water and Electricity |

|

R9. Occupational Health and Safety |

R10. Compliance Risk |

R11. Cyber Security |

R12. Carbon Border Adjustment Mechanism |

|

R13. Environment Protection, Climate Change and Biodiversity |

|||

- Risk Audit: At the start of each year, Internal Audit prepares an Annual Audit Plan after considering business and process risks; the frequency of audits is decided by risk ratings of areas/functions. The audit plan is reviewed periodically to include areas that have assumed significant importance in line with emerging industry trends and the aggressive growth of the Company. In addition to in‑house reviews, the Company engages external expert firms (including reputed accounting firms) to audit critical areas, strengthening independence and assurance.

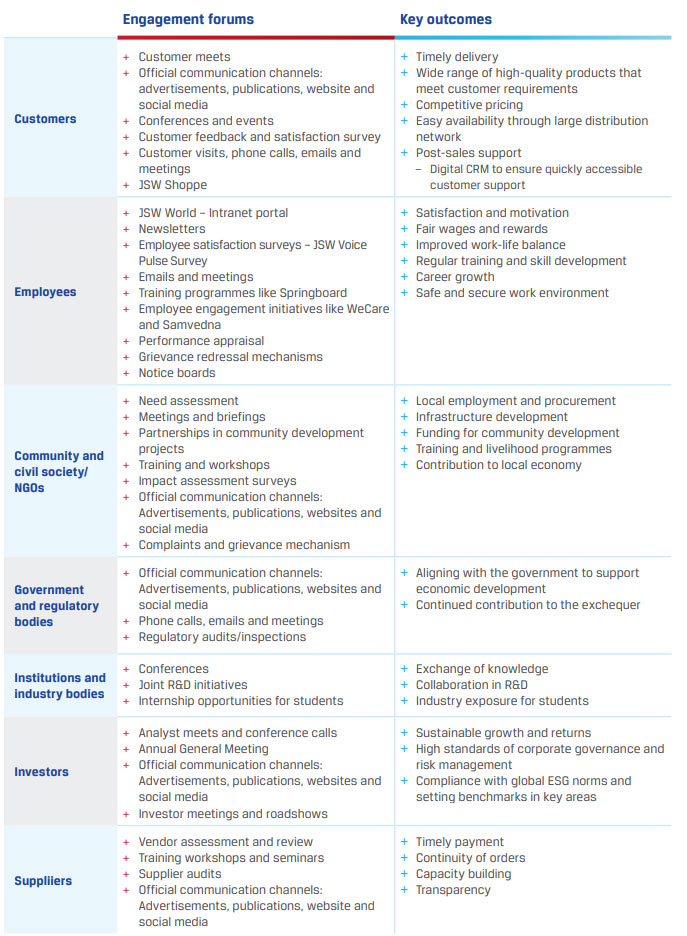

Stakeholder Engagement

Stakeholders are the key material topics for JSW. Stakeholder engagement refers to the trust-based, mutually beneficial relationships of the Company with key stakeholders such as investors, customers, vendors, society and government, among others. They are essential to business operations, and their feedback is vital for understanding their concerns and their material impact on the Company. JSW Steel’s stakeholder engagement strategy seeks feedback on a regular basis, which is then integrated into the organisation’s medium- and long-term strategy and planning exercises. This also enables the Company to promote the idea of shared growth and a common prosperous future for the society at large. The Company has formal mechanisms in place to engage key stakeholder groups in a constructive manner and collect valuable feedback. This proves to be a valuable input for the risk assessment and strategy formulation process of the Company.